House prices and the Stamp Duty holiday

Posted 12/11/2020 12:14House prices are soaring and it's looking like buyers are starting to pay more than they are saving!

Back in July, Chancellor Rishi Sunak introduced a Stamp Duty holiday in his summer budget. This meant that any potential homeowners would pay zero Stamp Duty on the first £500,000 of property purchases and it has helped to keep the market incredibly buoyant. So buoyant in fact, that lenders are overrun with more demand than they can supply. This is creating the unfortunate effect of pushing lending rates up, meaning good deals can be hard to come by. However, there seems to be some consensus among experts that house prices are being kept artificially high through excess demand and, as soon as the Stamp Duty holiday ends on 31/3/2021, house prices will settle back down to pre-July levels.

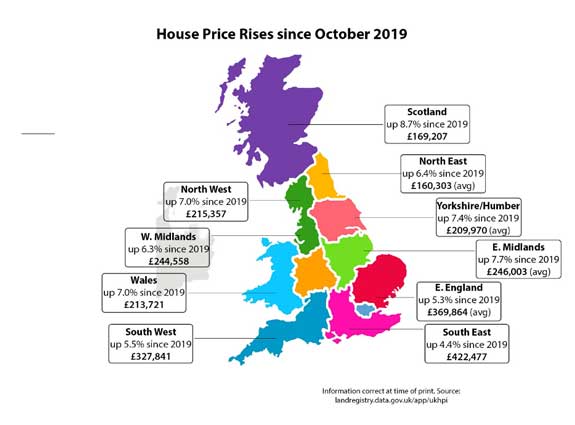

According to HM Land Registry, house prices, on average, across the whole of mainland UK have risen 5.5% since October 2019. With the largest increase in Scotland (8.7%) and the lowest rise in Greater London (2.6%). Forecasts made by reallymoving.com suggest that prices housing price gains could reach as much as 17.5% in December before they begin to dip.

This is a worrying time for lenders, who are extremely reluctant to engage with customers who require a high loan to value product (less than 15% deposit). The reason for this reticence is that lenders don’t want to find themselves owning property for which they have overpaid.

What does all this mean, in real terms, for potential home buyers?

With mortgage rates rising to counter the fluctuating property values across the country, prospective buyers should carefully research lender rates in their chosen area and be mindful of the true value of any potential new purchase. House prices are rising and falling on a monthly basis and so a careful observance of the market is in order. There are some lenders who have reduced the rates on a selection of their products and there is a degree of oscillation in lending rates across the board, so potential buyers should have all their ducks in a row and be ready to act quickly when the right deal comes along.

As we inch closer to the Stamp Duty holiday deadline, and with a huge amount of deals being chased, there is a note of caution. It is not enough to be in the process of a purchase when the holiday ends, buyers are only able to redeem the discount on completion. This means that the entire process must be concluded before the holiday deadline. Although, according to mortgagesolutions.co.uk,

“Property firms and trade bodies have come together to ask the government to extend the Stamp Duty holiday by six months as the industry struggles to keep up with demand for homebuying.”

It should not, however, be assumed that this will be granted. In fact, the housing minister Christopher Pincher has dismissed the possibility, saying:

“The temporary increase in the Stamp Duty Land Tax nil band rate was designed to provide an immediate stimulus to the property market, where property transactions fell during the Covid-19 lockdown. The government does not plan to extend this relief and will continue to monitor the property market.”